Goldman Sachs Head of Research: Gold is Set for Boom

November 15, 2021

Royal Ghana Gold Refinery to be Commissioned in August 2022

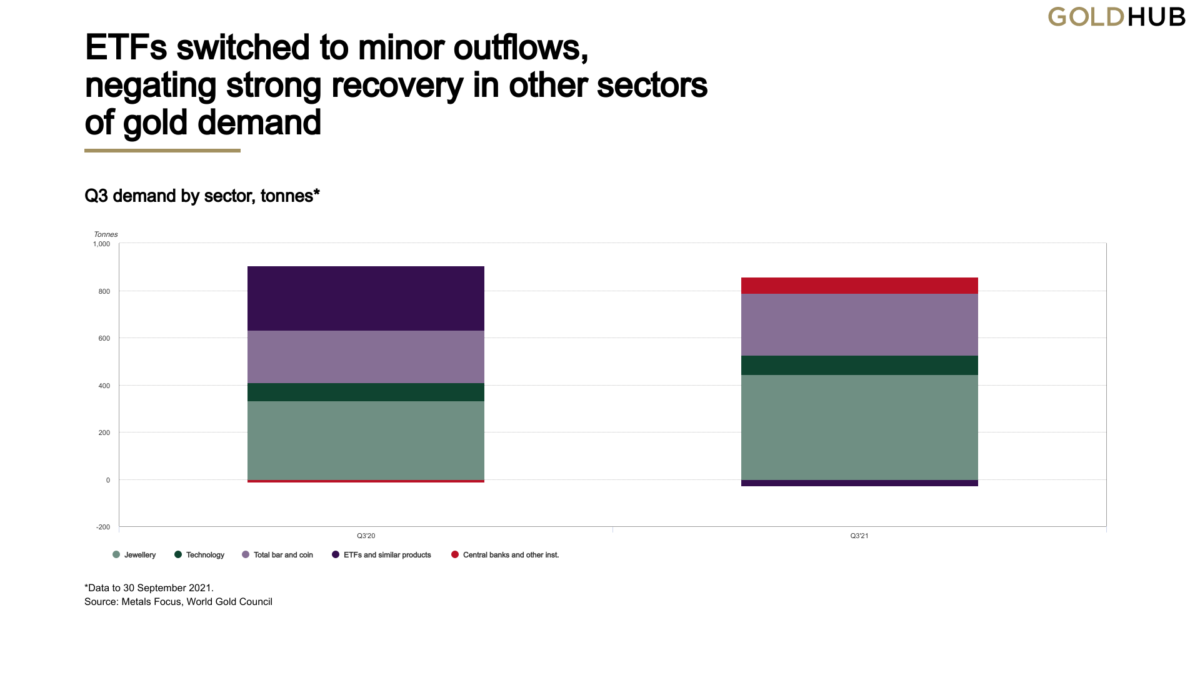

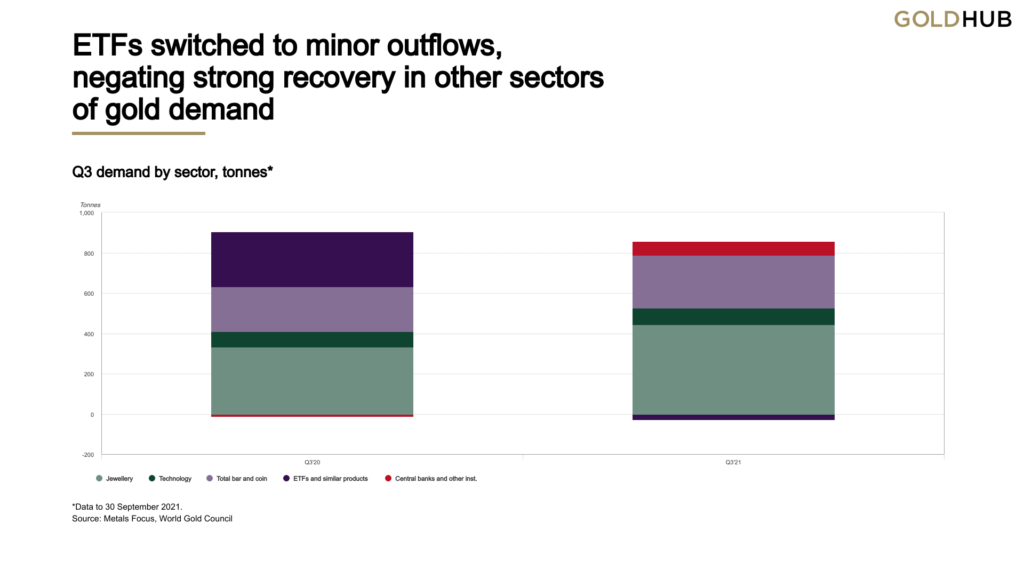

August 12, 2022Q3 gold demand down 7% to 831 tonnes

ETF outflows outweighed continued recovery in other sectors

Gold demand (excluding OTC) fell 7% y-o-y to 831t in Q3. This drop was almost exclusively driven by ETFs – which swung from very large inflows in Q3 2020 to modest outflows this year – overshadowing strength in other sectors of demand during the quarter. Jewellery, technology and bar and coin were significantly higher than in 2020. Modest central bank purchases were a solid improvement on the small net sale from Q3’20. Supply was down 3% y-o-y due to a significant drop in recycling.

Jewellery continued to draw strength from the ongoing global economic recovery: Q3 demand rebounded 33% y-o-y to 443t.

Bar and coin investment increased 18% y-o-y to 262t. The sharp August gold price dip was used by many as a buying opportunity.

Small outflows from global gold ETFs (-27t) had a disproportionate impact on the y-o-y change in gold demand, given the hefty Q3’20 inflows of 274t.

Central banks continued to buy gold, albeit at a slower pace than in recent quarters. Global reserves grew by 69t in Q3, and almost 400 y-t-d.

Technology gold demand grew 9% y-o-y, driven by continued recovery in electronics. Demand of 84t is back in line with pre-pandemic quarterly averages.

ETFs switched to minor outflows, negating strong recovery in other sectors of gold demand

Q3 demand by sector, tonnes*

Highlights

The gold price averaged US$1,789.5/oz in Q3, marginally lower than the Q2 average. The y-o-y comparison shows a 6% fall, reflecting the August 2020 record high US dollar price. Gold’s performance is consistent with its demand and supply dynamics and a macro environment of higher interest rates and risk-on investor appetite.

Year-to-date, gold demand is 9% lower. A doubling of central bank buying and 50% growth in jewellery demand over the first three quarters only partly offset the decline in ETF demand. Y-t-d demand remains notably weaker when compared with the same pre-pandemic period of 2019.

Gold supply is flat y-t-d. Mine production has steadily increased throughout 2021 and the y-t-d total is up 5%, but recycling has slowed down significantly, contracting by more than 12% over the same period.

Our full-year 2021 outlook shows a picture similar to the year so far. Ongoing economic recovery will benefit jewellery and technology; investment should draw support from continued inflation fears but relatively modest ETF flows compare negatively with 2020’s record inflows. Central banks are poised for an above-average year of net purchases.